Singapore property valuation – Have you ever wondered how much are Singapore’s residential properties worth in total? How much housing loan is outstanding in Singapore’s property market?

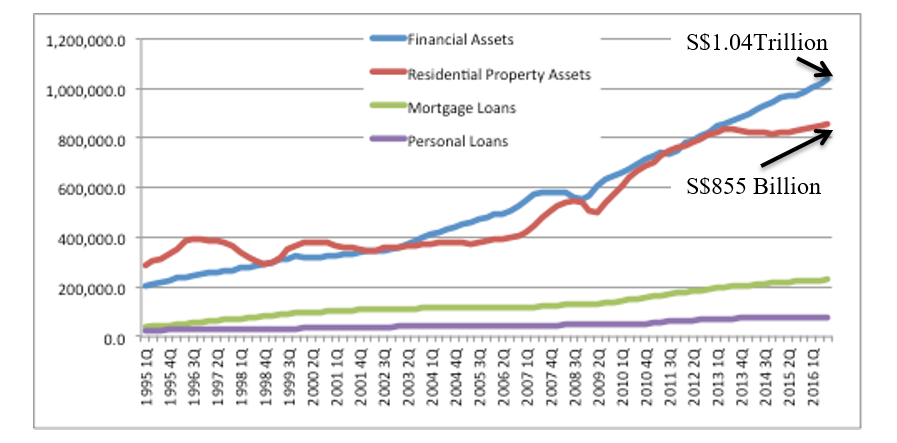

Chart 1: Total value of Singapore’s Residential Property assets, 3Q 2016, Singstat, iCompareLoan.com (Reference 1)

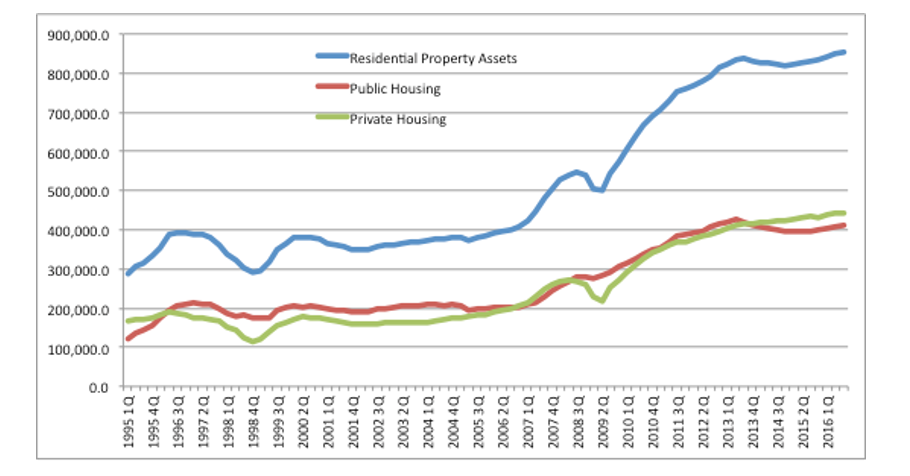

Singapore Property valuation: Private residential property makes up $443.682 billion while HDB properties totals up to $411.4197 billion.

The total value of Singapore’s residential properties is S$855 billion.

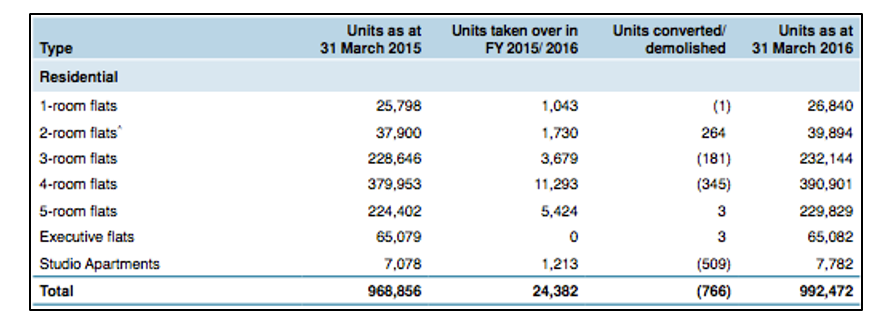

Total HDB residential units available and under management are: –

Table 1: HDB flat under management, HDB. (Reference 2)

HDB units under management as at March 2016 is 992,472 units. This implies a total of 992,472 HDB units available (including a few thousand rental units owned by HDB).

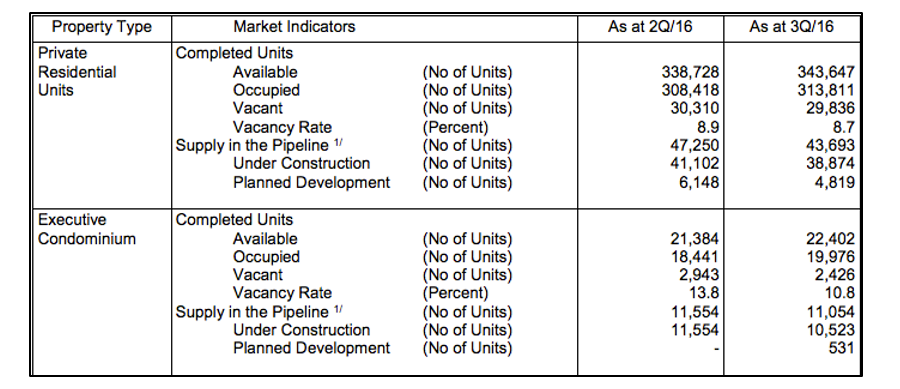

Table 2: Total stock of Private and Executive residential units, URA. (Reference 3)

There are some 343,647 + 22,402 = 366,049 units of Private Residential housing and EC based on URA Q3, 2016 figures.

Total housing HDB + Private + EC + rental units is 1,358,521 households.

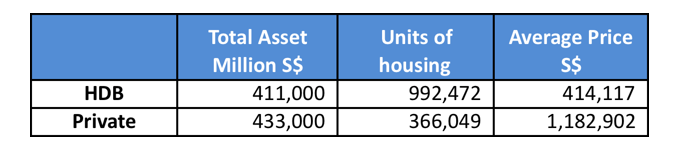

What is the average price of Singapore’s residential property?

Value of all HDB units is ~ S$411 billion with 992,472 units. This implies an average HDB price of ~ S$414,000.

Value of all Private residential units (including EC) is ~ S$443 billion with 366,049 units. This implies an average Private property price of S$1.21million.

Table 3: Average HDB and Private Prices

How does Singapore property valuation and asset Value compare with the world’s top companies?

Companies have become so powerful that they are much stronger than countries in many cases.

Figure 1: Top 5 companies by Market Capitalization, Bloomberg. (Reference 4)

As at 1st Aug, 2016, Apple has a market capitalization of US$578 billion. For simplicity, we use the exchange rate of US$1: S$1.4, apple would be worth S$809 billion. Just 1 company’s market capitalization is almost enough to buy up all of Singapore’s HDBs and Private residential properties.

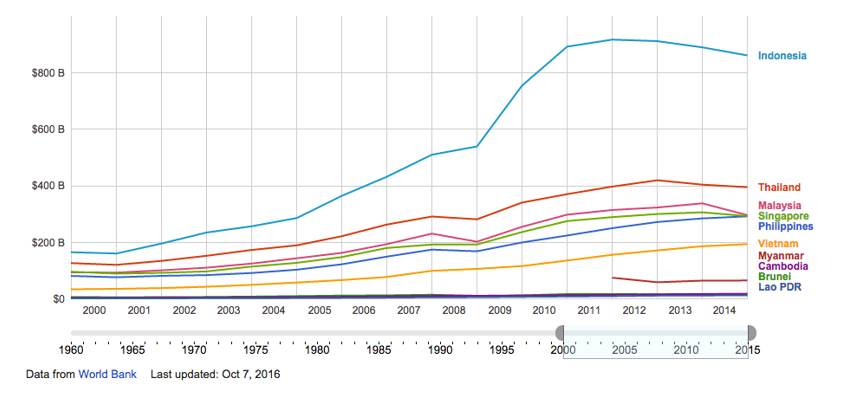

How does Singapore and Regional Economics compare with the world’s biggest companies by revenues?

Walmart is the world’s biggest company by revenue at US$482 billion, 20 July 2016 (Telegraph, reference 5)

Singapore’s GDP is S$402 billion (2015). For simplicity, US$1: S$1.4 is US$287 billion. Walmart’s revenues is US$482 billion.

Just Walmart alone produced 70% more than Singapore’s entire GDP and is bigger than the GDP of Thailand, Malaysia, Philippines, Vietnam, Myanmar, Cambodia, Brunei and Laos.

Chart 2: GDP of South East Asian Nations, GDP, World Bank, Reference 6

It is indeed a strange world where a single company could match the production/GDP of 9 of the 10 Asean nations.

Is Singapore’s Housing debt manageable?

Singapore’s residential property debt however is manageable where the asset value is about S$855 billion (both HDB and Private property) while the loan outstanding is about S$230 billion (HDB loan and those from Financial institutions). However do note that, of this S$855 billion, HDB assets S$414 billion can only be sold to realize the equity and cannot be refinanced for equity term loan.

For private residential property, obtaining equity term loan is possible.

Are Singapore Households Rich?

Chart 3: Singapore’s Private and Public residential asset value and outstanding debt, 3Q 2016, Singstat, iCompareLoan.com, (Reference 7)

Household financial assets have reached S$1.04 Trillion and Residential assets have reached S$855 billion based on today’s Singapore property valuation.

Singapore’s household net assets are S$1,588 billion dollars and approximately 1,358,521 property units (Assumptions: Vacant units ignored , negligible rental flats ignored), each household is worth about S$1.17m.

Singapore households are really rich, S$1.17m each household. At 3.3 to a household, that equates to a net worth of about $350,000 per person of which about more than half are in financial assets.

Maybe we have too many rich people in Singapore and that brings up the national average value. However, no matter how rich Singaporeans and Singapore Permanent Residents are, we need to realize that we are only a tiny region where single corporations do more revenues in a year than a Country’s GDP.

REFERENCES

- Total value of Singapore’s Residential Property assets, 3Q 2016, Singstat, iCompareLoan.com. http://www.singstat.gov.sg/statistics/latest-data#1

- HDB flat under management, HDB, http://www10.hdb.gov.sg/eBook/AR2016/key-statistics.html

- Total stock of Private and Executive residential units, URA, https://www.ura.gov.sg/uol/-/media/User%20Defined/URA%20Online/media-room/2016/oct/pr16-66e1.pdf

- Top 5 companies by Market Capitalization, Bloomberg,

https://www.bloomberg.com/gadfly/articles/2016-08-02/tech-giants-form-fab-five-to-dominate-stock-valuation-chart

- Walmart is the world’s biggest company by revenue at US$482 billion, 20 July 2016 (Telegraph) http://www.telegraph.co.uk/business/2016/07/20/revealed-the-biggest-companies-in-the-world-in-2016/

- GDP of South East Asian Nations, GDP, World Bank

- Singapore’s Private and Public residential asset value and outstanding debt, 3Q 2016, Singstat, http://www.singstat.gov.sg/statistics/latest-data#1