The Four Things That May Affect Your Credit Score Without You Knowing

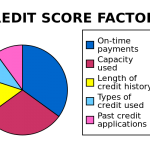

It’s a number that indicates how likely an individual is to repay his or her debt.

Having a good credit score will make it easier for you to obtain credit and qualify for loans, allowing you to own your dream home or start your own business.

You would probably know that failing to make your payment on time or defaulting on a bad debt is a big no-no when it comes to keeping a good credit score.

However, there are many other factors which you might not know that can hurt your credit. Here are four things for you to look out for!

- Not using credit at all

Not using credit cards at all may seem to be a good way to keep yourself out of debt, and by doing so you would probably be thinking that you will have scored that perfect credit score.

However, it does not work that way. There needs to be sufficient credit activity in your credit file in order to have a credit score.

If there’s insufficient credit activity, it would be unable to derive a score and you would see a non-scored risk grade of CX in your Credit Bureau Singapore (CBS) credit report instead.

Keep your credit active. Use your card, but in moderation. Over time, the good payment records will help you build up and boost your credit score. - Closing down old credit accounts

With so many credit cards offerings in the market these days, you may start finding your old credit cards to be unattractive and be tempted to terminate them.

However, these old credit accounts could actually be helping your credit scores. They provide data on how long you have been using credit, and how often you have paid your bills on time.

By closing off your old credit accounts and leaving only your new ones open, it could affect the age of your credit history and result in an immature credit history.

This generally indicates credit risk uncertainty to the lenders and may eventually affect your credit score.

Keep at least one or two old credit accounts open and active, and maintain good payment history with them. Establishing a healthy age of credit history will help you when lenders assess your credit risk. - Making minimum payment only

Many may think that as long as they make the minimum payment stated on their credit cards statements on time, it will still be deemed as a good payment record. That is hardly the case.

On top of the hefty interest charges the rollover balance will incur, the payment pattern of whether a full payment has been made for your credit card monthly is reflected in your credit report too.

Payment history is an important factor in determining your creditworthiness. Hence, strive to make the payment not only on time, but also in full. - Identity theft

Identity theft is the fraudulent practice of using someone else’s identity, usually as a method to gain a financial advantage or obtain credit and other benefits.

With the widespread use of internet and advanced technology nowadays, identity theft is a growing threat throughout the world.

Increasingly sophisticated and unpredictable methods are created and used to steal valuable personal information, such as phishing and mail theft.

Stolen personal information is most often used to perform credit fraud, which involves using the victim’s personal information to access credit in his or her name.

It can be in the form of making unwanted purchases to opening fraudulent credit accounts. Credit fraud may not only hurt you financially but also destroy the reputation you have built with banks and lenders.

Hence, it is important to be alert and discover identity theft early before it causes major damage to your credit score.

Closing thoughts

Your credit score is not something that can be repaired overnight. Safeguard your credit reputation with CBS My Credit Monitor.

It acts as your third eye to monitor your credit report, looks out for predetermined activities and notifies you as soon as the lender uploads information into your credit file, thus helping you to prevent identity theft and manage your credit reputation.