The collective sale site of Waterloo Apartments has been successfully concluded with a purchase price of $131.1 million. The buyers of the collective sale site, a wholly owned subsidiary of Fragrance Group, intends to redevelop the 999-year leasehold property, which has a land area of about 14,369 sq ft, into a hotel.

In one of the first few collective sale sites concluded after severe measures were imposed on the residential market on 6 July 2018, Property Consultants’ Cushman & Wakefield has sold Waterloo Apartments, located in the heritage Civic District to Fragrance Victory Pte Ltd for $131.1 million. This 999-year leasehold site has a land area of 1,334.9 sq m (14,369 sq ft approximately).

The collective sale site located at No. 64 Waterloo Street and within the Central Area comprising the Bras Basah and Bugis precincts obtained an ‘Outline Planning Permission’ or ‘OPP’ for a change in zoning from an existing “Residential with 1st Storey Commercial” with a plot ratio of 2.8 to a ‘Hotel’ use with a plot ratio of 4.2 or a total maximum gross floor area of 5,606.58 sq m (60,348 sq ft approximately). There are no development charges payable for the collective sale site due to the high development baseline for the site.

Each of the 30 apartment owners at the collective sale site will be getting an approximate gross sales proceeds of $4.37 million.

Table of Contents

The collective sale site is strategically located within walking distance to the Bencoolen MRT Station (Downtown Line) and the Bras Basah MRT Station (Circle Line). It is one train stop to the Dhoby Ghaut Interchange (serving the North-East, North- South and Circle Lines). Being so accessible to public transport provides ease of direct travel especially to nearby tourist ‘must-see’ locations such as Fort Canning, Little India, Chinatown, The Esplanade, Marina Bay Sands, The Gardens by the Bay, City Hall, Orchard, Raffles Place Central Business District and the Marina Bay Financial Centre (MBFC) for both tourist and business travellers.

According to Ms Christina Sim, Director of Capital Markets at Cushman & Wakefield, “We decided to change the course of the collective sale and instead of selling Waterloo Apartments as a residential development site, we opted to submit an OPP and wait for the hotel approval given that the residential enbloc market was reeling from the blow of the July 6 measures. We were also fortunate that the site is well located and within a zone which the URA would like to see enhanced into a kaleidoscope of delightful and memorable places.

“This offering gives the successful developer an opportunity to capitalize on our City’s rich heritage by building an exclusive boutique hotel befitting the Civic District. Visitor arrivals in 2017 grew 6.2% to a record high of 17.4 million while tourism spending rose to S$26.8 million. This momentum has continued into 2018 with tourist arrivals from January to July rising 7.4% year-on-year to 10.9 million. As Singapore continues to maintain its position as ‘The International Meeting City’ with prominent events being added to its calendar every year, demand for hotel rooms has improved with hotel occupancy rates averaging 85%.”

The sale of the collective sale site is subject to obtaining the Strata Titles Board approval.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

“Considering that residential en bloc sales have lost stream with the latest property cooling measures, the strategy employed by Cushman & Wakefield to submit an OPP and wait for the hotel approval, is a smart move,” said Chief Mortgage Consultant of iCompareLoan Paul Ho.

With the winding down of the success of residential en bloc sales, commercial properties are now trying to join in the bandwagon. Many commercial en bloc sale attempts fail because the asking prices are often too high. Two critical factors affecting the success of commercial sites going en bloc are pricing and location. Older commercial buildings especially, may see a need to catch the current wave as an exit strategy as their rental yields come under pressure due to competition from newer commercial buildings.

Whatever decision owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

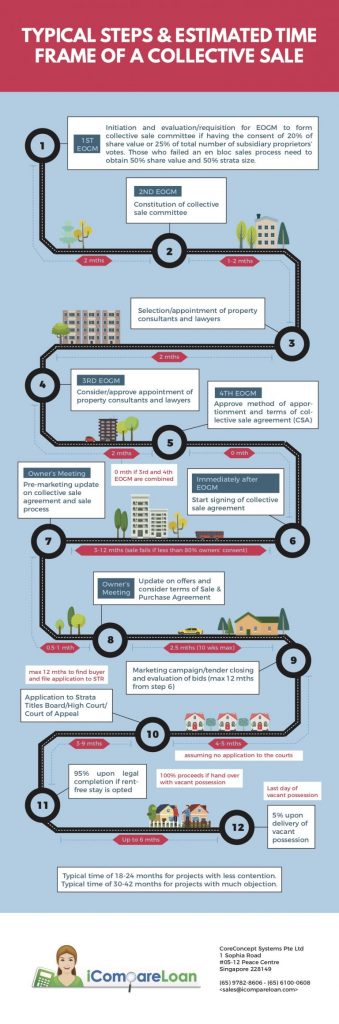

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new property early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

How to Secure the Best Commercial Loans Quickly

iCompareLoan is the best infomercial loans portal for commercial-property-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s the most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is a Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse home loan packages for their clients and give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!