Sibor and Sor, how does it affect your home loan mortgage rates and monthly instalment?

Much has been said about what is Sibor and what is SOR. Sibor stands for Singapore Interbank offered Rate while SOR stands for Swap Offered Rate.

Sibor and SOR comes in the following variants, overnight, 1 month, 3 month, 6 month, 12 month.

How does Sibor work?

In Sibor, banks lend to each other. Many people think that Sibor is traded on an exchange or an internal mechanism within Association of Banks of Singapore (ABS). Thomson Reuters is appointed as the calculation agent to collate the Sibor rate.

Each day, before 11:00 a.m. Singapore time.

Each contributor bank would provide the rates at which it could borrow funds, (were it to do so) by asking for and then accepting the interbank offers in reasonable market size.

There is no definition of reasonable market size, but widely believed to be in minimum tranches of S$10 to S$20 million.

The participating banks are: –

- Australia & New Zealand Banking Group Limited

- The Bank of Tokyo-Mitsubishi UFJ

- Bank of China Limited

- Barclays Bank PLC

- Bank of America, National Association

- BNP Paribas

- CIMB Bank Berhad

- Citibank N.A

- Credit Suisse AG

- DBS Bank Ltd

- Deutsche Bank Aktiengesellschaft

- The Hong Kong and Shanghai Banking Corporation Limited.

- JP Morgan Chase Bank NA

- Mizuho Bank Limited

- Malayan Banking Berhad

- Oversea-Chinese Banking Corporation Limited

- Standard Chartered Bank

- Sumitomo Mitsui Banking Corporation

- United Overseas Bank Limited

- UBS AG

When one bank borrows, it means another bank deposits funds with it. These deposit rates are then reported based on the following maturity, in Singapore dollars: –

- 1 Month

- 3 Month

- 6 Month

- 12 Month

A minimum of 12 banks shall submit rates for each maturity date for the day’s rates to be valid.

Let’s say by 11:00 a.m. and only 10 banks reported the rates, then there shall be no rate for that day.

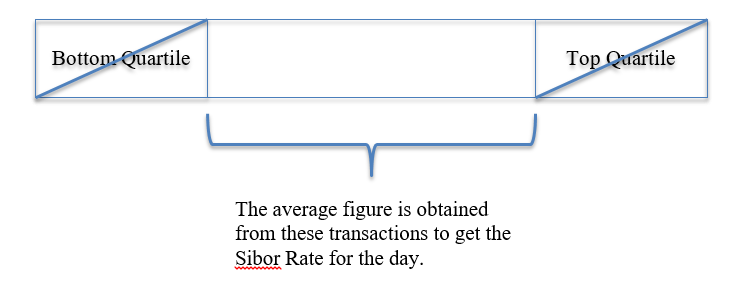

If more than a minimum of 12 banks reported the rates, the reported rates are then ranked from highest to lowest with the Top and bottom quartile truncated. The remainder transactions are considered valid and will be averaged to obtain the Sibor rate for the day.

How does Swap Offered Rate (SOR) work?

Many people have asked whether the SOR is more volatile and whether it is risky. Here we break down the mechanisms of how SOR comes about.

What is SOR? It stands for Singapore Dollar Swap Offer Rate (SOR).

“Cross Currency Swap is a legal agreement between two parties to exchange principal and interest payments in two different currencies on a periodic basic, for a specified period. Cross currency swap offers companies opportunities to reduce borrowing costs in both domestic and foreign markets. It is also a simple and effective solution for long term currency and interest rate hedging needs.” (Source: HSBC)

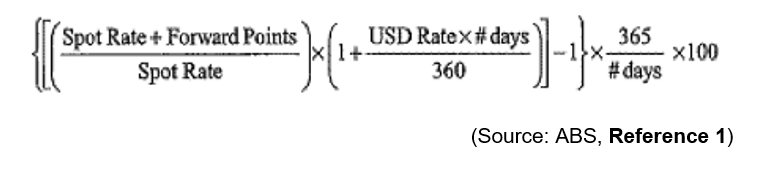

Spot Rate: This is the Currency exchange weighted spot rate of all qualifying transactions electronically routed through an approved broker. Only trades meeting the minimum notional amount will be counted. (Appendix 1: Trades to be counted as a Qualifying Currency Trade)

Forward Points – When banks swap a currency, say Singapore dollars into USD and back, they agree on the current spot rate (near leg) and a future spot rate (Far leg). If it is for a 3 month SOR, then the future is 3 months down the road.

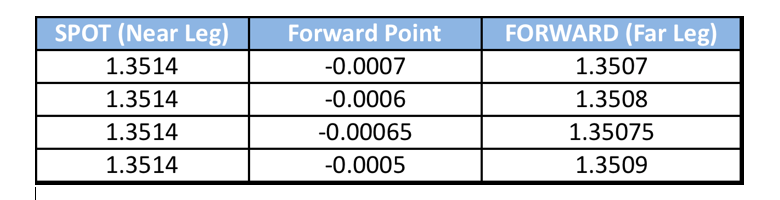

For example the Spot rate today is USD : SGD is 1:1.3514, 90 days later, the banks agree to swap back the currencies based on 1: 1.3511. This essentially means that the banks think that the USD will become weaker against the SGD.

Table 1: (Far Leg), www.iCompareLoan.com

Table 1: (Far Leg), www.iCompareLoan.com

Hence the Forward Point is calculated from using the Far Leg to minus the Near Leg.

USD Rate – This is the rate published on LIBOR01 for the similar period of maturity. For example you are calculating for 3 months maturity, then you will take the USD Rate for the similar 3 months maturity.

In short, the SOR is always a US Dollar versus the Singapore Dollar Swap unless otherwise stated.

Swaps are hedging instruments used in the bank’s treasury functions for risk management of currency risks.

For example: –

A business manufactures in Singapore, and its goods and material and labour are in Singapore dollars, but this business sells and quotes its prices in US dollars.

The business spends S$850,000 to build the products and sells it for S$920,000. Technically the business makes S$70,000.

If Today’s spot rate is US$1 : S$1.35.

The company is selling S$920,000 3 months down the road at today’s rate of US$1: S$1.35. Hence the company quoted US$681,481 to its buyers.

3 months down the road, nobody really know what the rate would be. There could be a financial crisis, war, terrorist or simply regulatory hurdles.

If the rate at 3 months later goes to US$1 : S$ 1.26.

The company receives US$681,481 and converts this to Singapore dollars to receive S$858,666. This essentially wiping out most of the company’s profits.

Therefore a company would be wise to spend a small cost to enter into a forward contract with a bank such as DBS, UOB, OCBC and others. If the market offers near leg US$1: S$1.3514 and at the far leg, US$1: S$1.3405 for instance, the company can pay a small cost to enter into such a legal contract with a bank.

Hence Swap Offered Rate (SOR) always include a foreign currency element, in this case the US Dollar. And because it takes into the account the Forward element of the US Dollar, there is an element of the market expectation of the strength of the US Dollar versus the Singapore dollar and vice-versa.

How does SOR behave against US Dollar versus Singapore Dollar exchange rate?

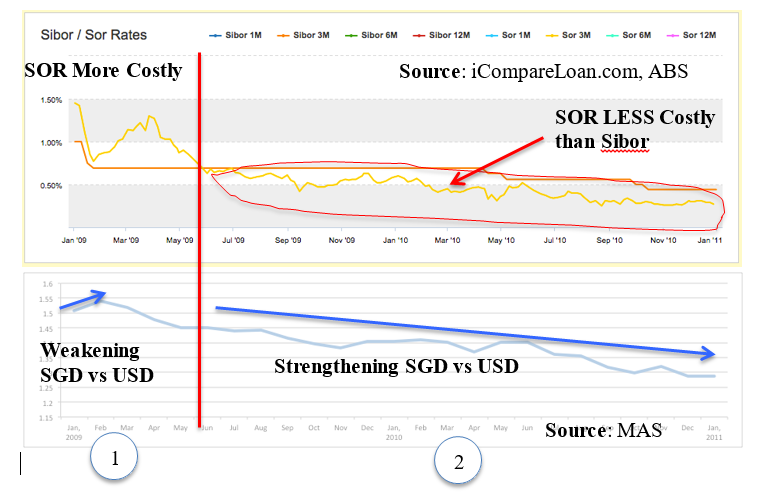

From Jan 2009 to Jan 2011.

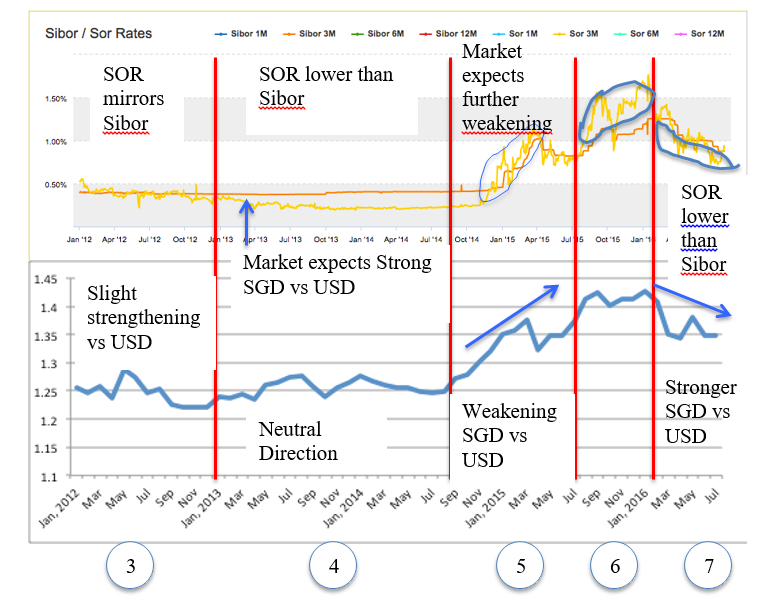

Chart 1: SOR, Sibor Correlation to Singapore Dollar : US Dollar exchange Rate

Chart 1: SOR, Sibor Correlation to Singapore Dollar : US Dollar exchange Rate

- Singapore dollar is weakening, SOR also expects Singapore dollar’s weakening and hence priced in this expectation. Hence for a bank that holds US dollar to swap into Singapore dollar, they expect a higher interest rate to compensate for this expected weakening. Later months, Singapore dollar started to strengthen, the SOR forward still expect Singapore dollar to weaken, hence SOR is still more costly than Sibor. After a while the forward market has acknowledged the trend that Singapore dollar is strengthening against the US dollar and SOR starts to drop.

- During this period, Singapore’s MAS adopts a currency appreciating stance. And taking the cue from the regulator’s policy stance, the market thinks similarly. Hence the forward factors in a strengthening Singapore dollar versus the US Dollar. Hence anyone holding the US dollar would be happy to hold on to the Singapore dollar and accept a lower Singapore dollar interest rate as the Singapore dollar’s appreciation compensates for the low Singapore dollar interest rate.

From Jan 2012 to Aug 2016

Chart 2: SOR, Sibor correlation to Singapore Dollar : US Dollar exchange Rate

- Directionless Singapore dollar versus US Dollar means that the market is neutral on where the Singapore dollar trends, hence SOR tracks Sibor closely.

- Market expects Singapore dollar to continue to be strong against the US Dollar and hence SOR is lower than Sibor. However the market was wrong as Singapore dollar is neutral against the US Dollar.

- During this time, the likelihood of the Federal reserve raising interest rates become more and more real. This is coupled with the recovery of the US economy and dropping unemployment rate. There are also events such as Swiss Franc de-pegging to the Euro, causing the US dollar to gain as it is the world’s largest reserve currency and seen as a safe harbor currency (despite its huge debt), hence US dollar gains against the Singapore dollar. Soon the forward market acknowledges it and SOR trades higher than Sibor.

- As the US economy further recovers, the market continues to expect the US dollar to strengthen against the Singapore dollar, as the SOR trades higher than the Sibor. However the market is wrong this time as US dollar only appreciated slightly against the Singapore dollar.

- On 14 April 2016, Monetary Authority of Singapore (MAS) adopted a neutral currency stance (MAS Monetary Policy statement, Reference 2). This means that Singapore dollar will neither appreciate nor depreciate against its trade weighted basket of currencies.

This means that there is more likelihood that the US dollar will strengthen against the Singapore dollar as US is on a recovery path whilst the rest of the world is slowing down.

Strangely even as Singapore adopted this neutral currency appreciation stance, the Singapore dollar strengthened against the US Dollar. And the market concurs with the SOR trading lower than the Sibor.

Should I choose Home Loan Packages based on Sibor or SOR?

Sibor and SOR tends to have similar mean (averages) over longer period of time.

However for the more adventurous, knowing that SOR’s pricing is more correlated to the Forward trend of the US dollar versus the Singapore dollar, if they think that the US dollar will gradually appreciate against the Singapore dollar, they could consider taking the Sibor. If they feel that the US dollar will depreciate against the Singapore dollar, then they could use a SOR structure as SOR will then likely be lower.

iCompareLoan can assist you in your choice of Home Loan packages.

Find out about what is SORA.

REFERENCES

- Association of Banks (ABS), Calculating Methodology, https://www.abs.org.sg/docs/library/calculation-methodology-abs-benchmarks.pdf

- MAS Monetary Policy Statements, http://www.mas.gov.sg/News-and-Publications/Speeches-and-Monetary-Policy-Statements/Monetary-Policy-Statements/2016/MAS-Monetary-Policy-Statement.aspx

Read about Fixed Home Rate or Fixed Deposit Pegged Rates

https://www.icompareloan.com/resources/when-is-fixed-not-a-fixed-rate/