Ryan Ong, iCompareLoan.com 08 July 2017

You know what’s more annoying that being broke? Being broke while sitting on a pile of gold. If you think that doesn’t happen, try asking a retiree with no income, but a $1.6 million condo that she can’t sell. The good news is, there’s a solution to that:

What is a home equity loan?

Table of Contents

A home equity loan is also called cash-out refinancing, or a second mortgage (but for marketing reasons, banks really hate the word “mortgage”, so you’ll rarely hear them say that).

A home equity lets you borrow money, while using your house as collateral. Before you laugh your ass off and leave the page, that’s not as terrible an idea as it sounds. You see, if you’ve run out of cash but have a valuable house, your usual choice is to sell and downgrade. But a home equity loan lets you get money out of your house, without having to lose it.

There are plenty of advantages: when your house is the collateral, the bank feels a lot more secure; they know you can’t exactly pack up your house and run away with it.

Because there’s something they can foreclose on, banks consider home equity loans to be low-risk, secured loans. That means they charge a super-low interest rate, seldom above 1.3 e per cent per annum. For reference, that’s less than a third of your CPF Ordinary Account rate (up to 3.5 per cent per annum), and about 1/6th of a personal loan rate (about six per cent per annum).

That super-low interest rate means home equity loans are quite cheap, and can provide a much bigger loan than you’d get through, say, a personal instalment loan. Most other, unsecured loans can only lend you up to four times your monthly salary (read: $0 if you’re retired and have no paycheque).

On top of this, the government recently made regulatory changes to home equity loan restrictions. If your house is already paid up, you can borrow up to half its value, without having to meet Total Debt Servicing Ratio (TDSR) restrictions.

Sadly though, home equity loans can only be used for private properties, HDB not allowed.

Who should use a home equity loan?

People who should consider home equity loans are:

- Owners of second or subsequent investment properties

- People looking to consolidate their debts

- Parents who want to help out their children

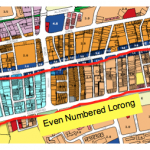

Image credits: Mercedes SLK, Paul Ho, iCompareLoan.com

- Owners of second or subsequent investment properties

If you own more than one property, home equity loans can reduce your liabilities, without your having to sell off a house. For example:

Say you own one condo (condo A), which is worth $1.6 million, and is fully paid up. You own a second condo (condo B), on which you have 10 years left on the mortgage, and you currently rent it out.

Let’s say you have $500,000 left to pay on condo B, and the interest rate on this is two per cent per annum. That’s about $3,400 a month in mortgage repayments, which is barely covered by the rental income of $3,500 a month (and heaven help you if the rental market falls even slightly, which would turn condo B into a liability).

You could take out a home equity loan on condo A, and borrow $500,000 at just one per cent per annum. The monthly repayment for this home equity loan would probably just be around $2,000 a month.

You then use the $500,000 you borrowed to pay off condo B. Now look at what happens:

You generate rental income of $3,500 a month, but the monthly repayments have fallen to just $2,000 per month. At the same time, you still fully own one property (condo B has been fully paid off).

If you have multiple properties, we might be able to work out a solution like this for you. Contact one of our expert mortgage brokers at iCompareLoan.com, and we’ll do our best to help.

- People looking to consolidate their debts

Forget what other personal finance websites tell you: no amount of saving on Starbucks coffee is likely to fix a major debt problem. If you owe, say, 12 months of your income, trying to go on budget now is like putting Tiger Balm on three broken ribs.

Typically, in such dire straits, the solution is to sell your house a downgrade. But you can consider a home equity loan as an alternative.

Let’s say you have $150,000 in unsecured loans, growing at about 24 per cent per annum (typical for credit cards). However, you have a house that’s almost entirely paid up; and it’s worth about $1.3 million, having appreciated over time.

You could take a home equity loan, borrowing $150,000 against your house, at just 1.3 per cent per annum. You then use the $150,000 to pay off all your other unsecured loans, thus consolidating all that high-interest debt into a single, low-interest home equity loan.

This reduces your monthly repayments to manageable levels, without you having to sell the house.

- Parents who want to help out their children

If you have reliable income sources, and want to help your children, a home equity loan can be the better option.

For example, if you have a paid-up condo worth $1 million, you can easily borrow up to $500,000 with a home equity loan (you won’t need to meet TDSR restrictions under the new rules). At 1.3 per cent per annum, this is cheaper than taking an education loan to send your kids to Harvard or wherever. It’s also cheaper than a HDB loan (2.6 per cent per annum), so you can help them buy a flat.

This is especially useful if you’re sitting on an appreciating property; you can finance your children’s aspirations, without having to lose a good retirement asset.

However, all of this is dependent on the bank be willing to extend the loan

It’s up to the bank’s credit officer, whether or not you can get a home equity loan. Two key things to remember are (1) you cannot take a home equity loan on public housing (HDB flats), it’s only available for private properties, and (2) banks look at factors such as your age and income. You may have to try with several banks before you can get one. Alternatively, drop us a message and we’ll do our best to find you a deal.