The Urban Redevelopment Authority (URA) released the 2nd Quarter 2019 private residential property price index flash estimate today.

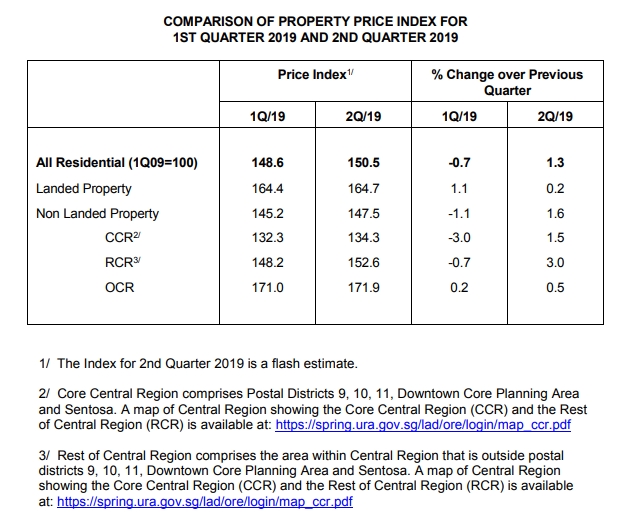

The 2nd Quarter 2019 private residential property price index flash estimate showed that overall, the private residential property index increased 1.9 points from 148.6 points in 1st Quarter 2019 to 150.5 points in 2nd Quarter 2019. This represents an increase of 1.3%, compared to the 0.7% decrease in the previous quarter.

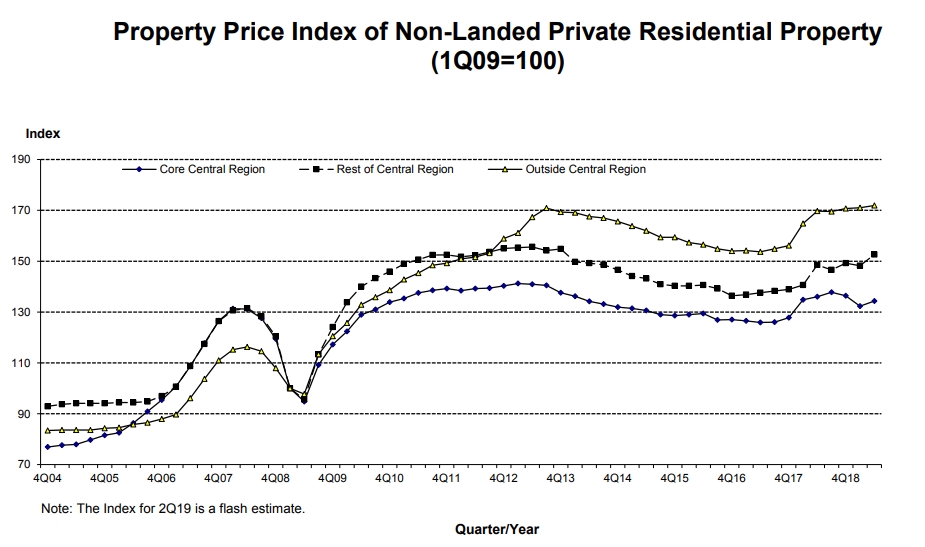

The 2nd Quarter 2019 private residential property price index flash estimate revealed that prices of non-landed private residential properties increased by 1.5% in Core Central Region (CCR), compared to the 3.0% decrease in the previous quarter.

Table of Contents

Prices in the Rest of Central Region (RCR) increased by 3.0%, after registering a decrease of 0.7% in the previous quarter. Prices in Outside Central Region (OCR) increased by 0.5%, following the 0.2% increase in the previous quarter.

The 2nd Quarter 2019 private residential property price index flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-June. The statistics will be updated on 26 July 2019 when URA releases its full set of real estate statistics for 2nd Quarter 2019.

Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. URA advised the public to interpret the 2nd Quarter 2019 private residential property price index flash estimates with caution.

Mr Desmond Sim, CBRE’s Head of Research for Southeast Asia commenting on 2nd Quarter 2019 private residential property price index flash estimate said:

“The URA flash estimate registered a positive change of 1.3% after two quarters of decline, bringing the year-to-date change for 2019 to +0.6%. This was contributed by a strong growth of 3.0% in RCR and 1.5% in the CCR prices in 2Q 2019.

The positive swing in the price index may be attributed to the following factors:

- New launches are achieving new benchmark pricing on the back of increased land costs. Some of the launches in the quarter sold well, as they were valued on their tenure, location and reputation of the developer.

- Traditionally, the secondary market has been a main downward drag for the price index. However, a significant slowdown in the secondary market has taken pressure off the price index. Based on caveats lodged, comparing 1H 2018 to 1H 2019, there was a significant reduction (-54.3%) in resale volume from 7,146 units to 3,266 units,. New sales on the other hand remained fairly stable at 3,874 units in 1H 2019, vis-a-vis 3,688 units in 1H 2018.

Nonetheless , CBRE believes that this is merely an anomaly from the previous two quarters. The property price index should remain relatively stable, with downward pressure coming only in the mid to long term based on the following:

- While the outlook of rising interest rates may not happen, global economic forecasts have been revised downwards resulting in greater uncertainty.

- More launches are expected in the near term to add more pressure on the rising unsold inventory.

- Developers are still not fazed by the sell-by deadlines and are unlikely to reduce price.

Therefore, CBRE supports the stance of market regulators to allow for more time for the market to stabilize before relooking the property cooling measures.”

OrangeTee & Tie’s head of research and consultancy Christine Sun said: “This uptrend is within expectation as new homes sales currently form the lion’s share of the property market and many new projects are selling at new benchmark prices for their locations in recent months.”

JLL’s senior director of research and consultancy Ong Teck Hui said: “The key observation from the second quarter 2019 flash estimates is the firm demand for new high-end homes in CCR as well as attractive locations in RCR in spite of the cooling measures, which do not seem to deter buyers who are keen on such properties. This should augur well for potential launches with such attributes as there is a fair chance of them achieving better sales take-up.”

Ms Christine Li, head of Singapore and Southeast Asia research at Cushman and Wakefield, said the 2nd Quarter 2019 private residential property price index flash estimates showed that “underlying demand is still very resilient despite the cooling measures.”

She added that despite the uncertainty caused by the US-China trade tensions, investors remained positive on the long-term prospects of the residential market in Singapore. The rebound in prices showed that Singapore remains an international financial hub.

Mr Paul Ho, chief mortgage consultant at iCompareLoan said, “demand could have been boosted by owners who sold their previous residential property in a collective sale, and are looking for a new home.”

How to Secure a Home Loan Quickly

Do you want to buy prime homes but are unsure of funding? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Home Loans in Singapore before deciding on your next purchase. Our brokers have close links with the best lenders in town and can help you compare Singapore’s best commercial loans and settle for a loan package that best suits your commercial purchase needs.

Whether you are looking for a new commercial loan or for a refinancing package for your commercial properties, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates, all through to securing the best commercial loans which fits your profile. And the good thing is that all our services are free of charge. So it is all worth it to secure the best commercial loans through us.

You may contact us today for advice on a new home or refinancing advice, or for Personal Finance advice.

You may also speak to our Panel of Property agents.