Homeowners with outstanding OCBC home loans, it’s time to pay attention. For those of you who are first time homeowners, Singapore’s interest rate has a strong positive correlation with the US. This means that as US takes the lead in raising its Federal funds interest rate, Singapore’s interest rate will follow suit. In particular, the Singapore Interbank Offer Rate (SIBOR) and Swap Offer Rate (SOR) has been steadily rising since October 2016.

OCBC Bank Mortgage Loan

Image Credits: OCBC Bank Holland Village, Paul Ho, iCompareLoan.com

Considerations for finding the best ocbc home loans

Table of Contents

As we enter the cycle of interest rate hike, your decision on which loan package to choose or refinance could make a huge difference. This might be the time to switch out from your current loan to take on a more advantageous loan to reduce the impact of rising interest rates. To help our readers make wiser home loan choices, we have done an analysis to understand the trend of home loan interest rates from OCBC.

Let’s First Understand The Fluidity Of Benchmark Rates

We understand that many of you might be on loan packages that uses SIBOR as the benchmark rate. Among the types of benchmark interest rates, SIBOR is typically the first to be adjusted. It is then followed by benchmark rates that are tied to deposit savings interest rates. This is because of the nature of each benchmark rate.

SIBOR, being the most fluid benchmark rate, changes every day. There are a few types of SIBOR ranging from one, three, six to 12 months. Next in line in terms of fluidity is OCBC’s latest OCBC home rate (OHR), which uses the 12-month moving average of the 1-month and 3-month SIBOR as a reference. Since OCBC home rate uses the 12-month moving average, it is less prone to adjustments.

OCBC’s FDMR and later Home Rates (OHR): Introduced To Rival Its Competitors

FDMR would be third in line in terms of fluidity. Prior to introducing its OCBC home rate (OHR), OCBC had the fixed deposit-linked home rate (FDMR). FDMR loans were replaced by OHR in late 2017. So, if you had taken up a loan prior to 2017, you might still be under loans that are pegged to OCBC’s FDMR. However, after a few years since DBS introduced its fixed deposit rate (FDR) home loans, OCBC is finally introducing its own bank-managed rate to rival DBS’ FDR. OHR allows you to choose between a fixed or floating one, which is similar to DBS’ FDR home loan packages. It appears that OCBC introduced its OHR to make its loan packages more competitive relative to its rivals, especially DBS.

Read also: Best DBS Home Loans and past Sibor and FHR rate Trends

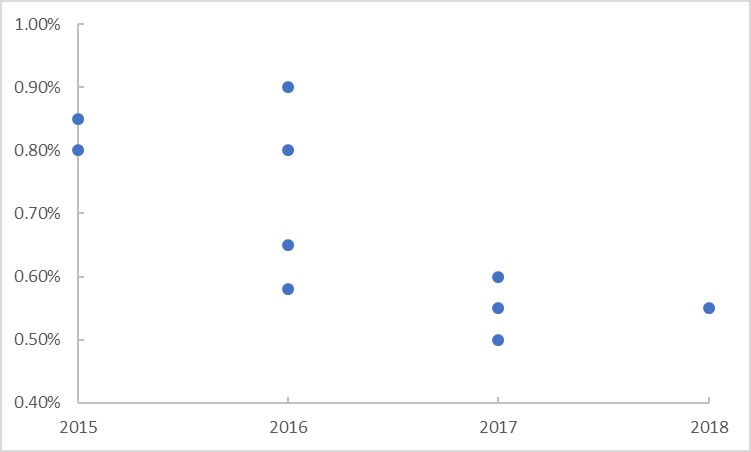

OCBC home loans Trend: Home Loan spread for Sibor Have Been Decreasing

Chart: Sibor Spread from OCBC home loan packages, Si Jie, iCompareLoan.com

OCBC home Loans – Sibor Historical Rates

|

Date |

OCBC Sibor Bank Loan Package |

Spread |

|

21-Jan-15 |

Ocbc 3M Sibor 3 Years Lock In Completed (Min $350k) |

0.8 |

|

21-Jan-15 |

Ocbc 3M Sibor No Lock In Special |

0.8 |

|

26-Jan-15 |

OCBC 3M SIBOR 3 Years Lock In With Cash Rewards For Refinance |

0.85 |

|

26-Jan-15 |

OCBC 3M SIBOR No Lock Completed (Min $350K) |

0.85 |

|

3-Feb-16 |

OCBC 3M SIBOR 3 Yrs Lock-In For Private Properties (Min 1M, Deviated Package) |

0.8 |

|

16-Mar-16 |

OCBC 3M SIBOR 3 Yrs Lock-In For Private Properties |

0.9 |

|

29-Apr-16 |

OCBC 3M SIBOR No Lock-In For BUC Private Properties |

0.9 |

|

29-Apr-16 |

OCBC 3M SIBOR 3 Yrs Lock-In For Private Properties |

0.9 |

|

18-May-16 |

OCBC 3M SIBOR No Lock-In For BUC Private Properties |

0.9 |

|

20-Sep-16 |

Ocbc 1M Sibor |

0.58 |

|

26-Oct-16 |

Ocbc 1M Sibor |

0.65 |

|

26-Oct-16 |

OCBC 1M SIBOR No Lock-In For BUC Private Properties |

0.65 |

|

25-Nov-16 |

Ocbc 1M Sibor |

0.65 |

|

15-Jan-17 |

OCBC 1M SIBOR Package – 2 Years Lock In |

0.6 |

|

15-Jan-17 |

OCBC 3M SIBOR – 2 Yrs Lock-In For HDB/Private Properties |

0.5 |

|

15-Jan-17 |

OCBC 3M SIBOR – 2 Yrs Lock-In For HDB/Private Properties |

0.5 |

|

15-Jan-17 |

OCBC 3M SIBOR – 2 Yrs Lock-In For HDB/Private BUC Residential |

0.5 |

|

22-Feb-17 |

OCBC 1M SIBOR Package – 2 Years Lock In |

0.6 |

|

7-Mar-17 |

OCBC 1M SIBOR Package – No Lock In |

0.5 |

|

19-Jul-17 |

Ocbc 1M Sibor – Building Under Construction |

0.6 |

|

19-Jul-17 |

Ocbc 1M Sibor – Completed Property |

0.55 |

|

18-Aug-17 |

Ocbc 1M Sibor – Completed Property |

0.55 |

|

18-Aug-17 |

Ocbc 1M Sibor No Lock In – Building Under Construction |

0.6 |

|

9-Oct-17 |

Ocbc 1M Sibor – Completed Property |

0.55 |

|

9-Oct-17 |

Ocbc 1M Sibor – Properties Under Construction |

0.6 |

|

7-Jan-18 |

Ocbc 1M Sibor No Lock-In – Building Under Construction |

0.55 |

*BUC – Building Under Construction

Overall, we have seen a decreasing trend on the home loan rates across all the types of loans offered by OCBC. The spread on OCBC’s SIBOR loans peaked in first half of 2016. But since its 2016 peak, the spread on SIBOR loans have been decreasing. Right now, OCBC’s latest loans offered in 2018 has one of the lowest spread since 2015. Similarly, OCBC’s FDMR/OHR loans and fixed interest loans also experienced a peak in first half 2016 before declining gradually to its low late last year.

Find the Best Ocbc Home Loans using this Home Loan Calculator

Fixed Interest Rates vs SIBOR-Pegged RatesWhen you were choosing which loan package to sign, you had the choice between fixed and floating interest rates (e.g. SIBOR or OHR). While fixed interest rates might sound like the “safer” option as it removes the uncertainty from your loan’s interest rate amount, the data that we have collected doesn’t reflect that safety.In order to offer you fixed interest rates (and still make money), OCBC has to add an additional buffer to protect its profits. Based on the data, we observe that OCBC home loans has been adding in additional buffer of 0.05-0.1% spread to its fixed interest rates loan compared to SIBOR loans. As such, OCBC’s fixed interest rates continue to be more expensive due to the built-in spread. This is despite SIBOR’s increase since 2016. Unless certainty is really so important to you, our advice is to take on some uncertainty but save some money for yourself with SIBOR-pegged loans from OCBC.

OCBC Home Loans: Should Bargain Hunters be switching out of SIBOR Loans?

If you are currently on SIBOR loans, should you be switching out of them to other benchmark rates? Based on our analysis, SIBOR loan isn’t the best deal you can get among the three types of OCBC home loans. If you really want the best bargain, OCBC’s OHR loan could be the ideal choice.

Image Credits: US Fed funds rate Sibor Rate Chart, Trading Economics

Image Credits: US Fed funds rate Sibor Rate Chart, Trading Economics

The US Federal Reserve Central Bank raised its interest rate for the first time in 2016 since the historical low Fed fund rate of 0.25%. Since then, the US Central Bank has been increasing its interest rate to its latest Fed fund rate of 1.5%. If you observe the SIBOR trend, it follows suit the movement of Fed fund rate, albeit not fully in tandem.

Since OCBC’s OHR uses a 12-month average of 1-month/3-month SIBOR, it is less affected by short term movement of SIBOR. Yet, at the same time, it also enjoys the advantage of the floating SIBOR, especially if SIBOR dips. Moreover, given that we are currently in an environment of rising interest rates, SIBOR is expected to trend upwards. Homeowners that have signed SIBOR loan packages should brace yourselves for a much more volatile ride compared to those who are currently on OHR loan as the Federal Reserve signals more rate hikes.However in May 2018, OCBC emphasised that OCBC Home loans for OHR is not pegged to 12 year sibor rates and has never been, but there were some wordings that were used that seem to indicate that OCBC home loans based on OHR is actually just another board rate and is not pegged to anything except to the cost of funds.

OCBC Home loans – FDMR and OHR Historical Rates

| Date | OCBC Bank Loan Packages | 1st Year Interest Rate (%) | 2nd Year Interest Rate (%) | 3rd Year Interest Rate (%) | 4th Year Interest Rate (%) | 5th Year Interest Rate (%) | Interest Rate Thereafter (%) |

| 4-Apr-15 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In | 1.38 | 1.68 | 1.88 | 2.65 | 3.75 | 3.75 |

| 4-Apr-15 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In For Private Properties | 1.38 | 1.68 | 1.98 | 2.65 | 3.75 | 3.75 |

| 30-Apr-15 | OCBC Fixed Deposit Mortgage Rate (FDMR) Without Lock-In For Private Properties | 1.68 | 1.98 | 2.28 | 2.65 | 3.75 | 3.75 |

| 18-Jun-15 | OCBC Fixed Deposit Mortgage Rate (FDMR) Without Lock-In For Private Properties BUC | 1.4 | 1.5 | 1.6 | 2.65 | 3.75 | 3.75 |

| 22-Jul-15 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In | 1.58 | 1.78 | 1.98 | 2.65 | 3.75 | 3.75 |

| 4-Feb-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In For Completed Private Properties (Refinance) | 1.58 | 1.78 | 1.98 | 2.65 | 3.75 | 3.75 |

| 11-Feb-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) Without Lock-In For Private Properties BUC | 1.8 | 1.8 | 1.8 | 2.35 | 2.35 | 2.35 |

| 11-Feb-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In For Completed Private Properties (New Property) | 1.8 | 1.8 | 1.8 | 2.35 | 2.35 | 2.35 |

| 11-Feb-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In For Completed Private Properties (Refinance) | 1.88 | 1.88 | 1.88 | 2.35 | 2.35 | 2.35 |

| 11-Feb-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) Without Lock-In For Private Properties | 1.88 | 2.18 | 2.48 | 2.65 | 3.75 | 3.75 |

| 15-Feb-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In | 1.63 | 1.63 | 1.63 | 2.15 | 2.15 | 2.15 |

| 16-Mar-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 2 Years Lock-In | 1.68 | 1.68 | 1.68 | 2.15 | 2.15 | 2.15 |

| 16-Mar-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In For Private Properties | 1.68 | 1.98 | 2.28 | 2.65 | 3.75 | 3.75 |

| 25-Mar-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 2 Years Lock-In | 1.88 | 1.88 | 1.88 | 2.35 | 2.35 | 2.35 |

| 29-Apr-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Years Lock-In for Private Properties | 1.75 | 2.05 | 2.35 | 2.65 | 3.75 | 3.75 |

| 18-May-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 2 Years Lock-In For Private Properties | 1.7 | 1.8 | 2.25 | 2.65 | 3.75 | 3.75 |

| 18-May-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With No Lock-In For BUC Private Properties | 1.88 | 2.18 | 2.48 | 2.65 | 3.75 | 3.75 |

| 9-Jun-16 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 3 Yrs Lock-In For Completed Properties | 1.65 | 1.65 | 1.8 | 1.8 | 1.8 | 2.35 |

| 4-Mar-17 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 4 Years Lock in – For Residential BUC Properties | 0.7 | 0.65 | 0.6 | 0.55 | 1.55 | 1.55 |

| 14-Aug-17 | OCBC Fixed Deposit Mortgage Rate (FDMR) With 2 Years Lock-In | 1.25 | 1.25 | 1.3 | 1.4 | 2.25 | 2.65 |

| 18-Aug-17 | OCBC Fixed Deposit Mortgage Rate (FDMR) Without Lock-In | 1.4 | 1.5 | 1.5 | 1.5 | 2.25 | 2.65 |

| 11-Oct-17 | OCBC Home Rate (OHR) – Properties Under Construction | 1.35 | 1.35 | 1.4 | 1.6 | 1.8 | 2 |

| 3-Nov-17 | OCBC Home Rate (OHR) | 1.35 | 1.35 | 1.4 | 1.6 | 1.6 | 1.6 |

| 4-Nov-17 | OCBC Home Rate (OHR) – Completed Property | 1.35 | 1.35 | 1.35 | 1.6 | 1.6 | 1.6 |

Here is any overview of the best home loans in Singapore.

You may want to check out OCBC OHR home loan structure to understand what it is.

https://www.icompareloan.com/resources/ocbc-ohr-mortgage-rates-ohr/