The Fed interest rates lowering is expected to have an impact in Singapore. Interest rates were lowered by half a percentage point by the United States’ Federal Reserve (Fed) on March 3rd. The Fed interest rates lowering is the third since 2019 for a total of 75 basis points.

The Fed interest rates lowering was much anticipated as the American economy is affected by the Covid-19 situation.

Table of Contents

In a press statement, Fed said: “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent.”

“The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy,” it added.

Federal Reserve Chair Jerome H. Powell said on Feb 28, “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

In its 11th year of a record expansion, the U.S. economy is in a good place. The labor market remains strong, economic activity is increasing at a moderate pace, and the Federal Open Market Committee’s (FOMC) baseline outlook is for a continuation of this performance in 2020.

Although the fundamentals supporting household consumption in the US remained strong in 2019, sluggish global growth weighed on investment, exports, and manufacturing in the United States. In particular, the emergence of the Covid-19, which is likely to have a noticeable impact on global development, at least in the first quarter of this year. This disruption could spill over to the rest of the global economy.

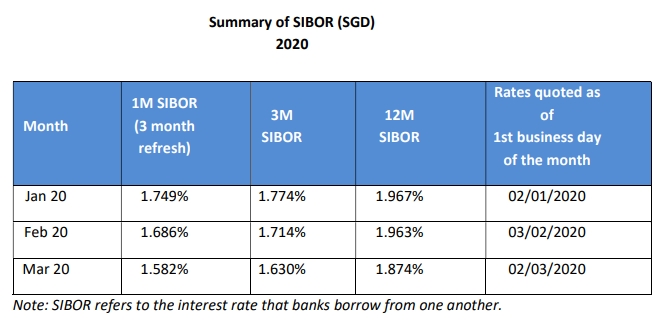

The Fed interest rates lowering is expected to have an impact on credit cards, mortgages, vehicle loans and bank savings accounts here. This is because Singapore interest rates are closely correlated with those in the US. The SIBOR (Singapore interbank offered rate) for example is expected to go down. This could bring back some of the enthusiasm to the suppressed property market.

After a series of Fed interest rates lowering, Singapore interest rates and home loans could be headed south.

Some banks began cutting their home loan interest rates as early as April last year. DBS and UOB were among the early movers offering between 2.38 per cent and 2.48 per cent in April, from around 2.58 per cent to 2.68 per cent earlier. In mid-July, rates below 2 per cent appeared with DBS offering three-year fixed-rate home loan package with a first-year rate of 1.89 per cent as a “National Day special”.

But are even lower rates possible? If the coronavirus continues spreading, then it is a definite “yes”. The worse the COVID-19 outbreak gets, the lower mortgage rates will go. If Covid-19 becomes an epidemic in the United States, then rates on home loans are likely to fall even further.

Since the third quarter of last year, banks have lowered interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already lowered their mortgage rate to 1.7 per cent, to keep pace with the decreasing interest rates.

The 3-month SIBOR has is 1.7 cent since Jan. The further lowering announced by the Fed on Tuesday is expected to drive the interest rates for mortgage loans further down.

DBS is now charging 1.8 percent a year for each of the three years for its 3-year fixed rate package, while UOB recently lowered its 3-year fixed rate package to 1.78 percent a year for each of the three years. OCBC, on the other hand, brought down its 2-year fixed rate package to 1.75 per cent.

Homeowners who are worried about the other types of home loans with interest rates that are exceptionally volatile, might opt for good fixed rate mortgages. Fixed rate mortgages may give homeowners thousands of dollars (perhaps even a five-figure sum or more) each year. Homeowners could potentially also enjoy a two-three times difference in their total interest repayment if they opted for fixed rate mortgages.

Some homeowners may however miss out on such potential savings because they are overwhelmed by the banking process. Others might be put off by technical jargon like SIBOR, FHR, Board Rates. Such homeowners may hesitate to explore fixed rate mortgages and wish for someone to just hand them the cheapest home loan package across 16 banks.

Some reasons why homeowners may hesitate

- Unsure of the loan amounts they are eligible for and how to calculate them.

- Unsure as to when or why they should refinance.

- Unsure about how the new banking regulations is affecting them.

- Unsure of the loan tenure they should go for.

- Unsure about the amount of CPF they should use for the purchase of their homes.

And there is good reason why homeowners are unsure and unfamiliar on how to get the best deal interest rates for their home loans. Most don’t buy homes as often as you buy other necessities (like food and clothes). But actually, there is no reason why you should contribute to the banks’ profits when you can keep the difference in interest rates.

All such homeowners need to do is, look for a mortgage specialist. The mortgage specialists will give them the advice that they need at zero cost to the homeowners. In case you are wondering why the service by the mortgage broker is free to the borrower – it is because the lenders will pay the mortgage broker a distribution fee upon successful disbursement of loan.

Brought to you by https://www.icompareloan.com