CBRE on Jan 7 launched the sale of HighPoint at 30 Mount Elizabeth via Public Tender. Prominently located within the prime Mount Elizabeth-Orchard district, one of Singapore’s most prestigious enclaves, the HighPoint sits on a freehold cul-de-sac plot of approximately 47,606 sq ft on Mount Elizabeth Road, a gentle hillside route from Orchard Road leading to the most elevated point of Mount Elizabeth.

According to the URA Masterplan 2014, the site is zoned “Residential” with a height control of up to 36 storeys. The existing gross floor area (GFA) has been verified by the authorities at approximately 211,976 sq ft, equivalent to a plot ratio of approximately 4.45. In addition, based on the URA development baseline reply, there is no development charge payable up to GFA of approximately 213,383 sq ft. Assuming an average apartment size of 100 sq m, the site can accommodate up to 196 dwelling units. Pre-application feasibility study is also not required for this site.

HighPoint currently comprises 57 apartments and two penthouses. More than 80% of the owners have signed the Collective Sale Agreement (CSA).

Table of Contents

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

Nestled within an enclave featuring ultra-luxurious residential developments including The Ritz Carlton Residences, The Scotts Tower and hotels like Goodwood Park Hotel, The Grand Hyatt Hotel, Grand Park Orchard Hotel, the site enjoys the rarity of privacy within one of the most prestigious districts in Singapore and the convenience of being a stone’s throw on foot to the bustling Orchard Road, Singapore’s world-renowned main shopping belt.

Premier retail malls such as ION Orchard, Paragon and Ngee Ann City; medical facilities such as Mount Elizabeth Hospital, Paragon Medical; and Tanglin Club and American Club are all also within walking distance. Also, in close proximity are Anglo-Chinese Junior School, Chatsworth International School (Orchard Campus), and Singapore Chinese Girls’ School.

The HighPoint also enjoys seamless connectivity with the Orchard MRT station located merely a seven minutes’ walk away and major arterial roads and expressways, such as the Central Expressway (CTE), Orchard Road and Cairnhill Road, providing easy connectivity from the site to other parts of Singapore.

The guide price for HighPoint is S$550 million, which works out to S$2,595 per square foot per plot ratio.

Taking into consideration the 7% bonus gross floor area for balconies, the land price will be approximately S$2,509 per square foot per plot ratio.

Galven Tan, Executive Director, Capital Markets, CBRE said, “A site with attributes like HighPoint rarely becomes available. The potential 36-storey height will offer unblocked panoramic views featuring the lush greenery of Goodwood Hill and the CBD skyline. Its exclusivity presents immense potential to create a one-of-a-kind Orchard Road landmark which will attract ultra-premium developers.”

He added: “As part of our pre-marketing exercise, we have received positive feedback from a number of foreign developers. At S$2,595 ppr (before factoring in balconies), the site is very attractively priced. Overall supply in the ultra-luxurious segment of the market remains very limited, and we believe the interest and pricing will continue to hold firm.”

The public tender for HighPoint will close at 3pm on 26 February 2019.

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said it is good that more than 80% of the owners have signed the CSA, as the sale can be concluded with minimal delay and maximum benefit to the owners.

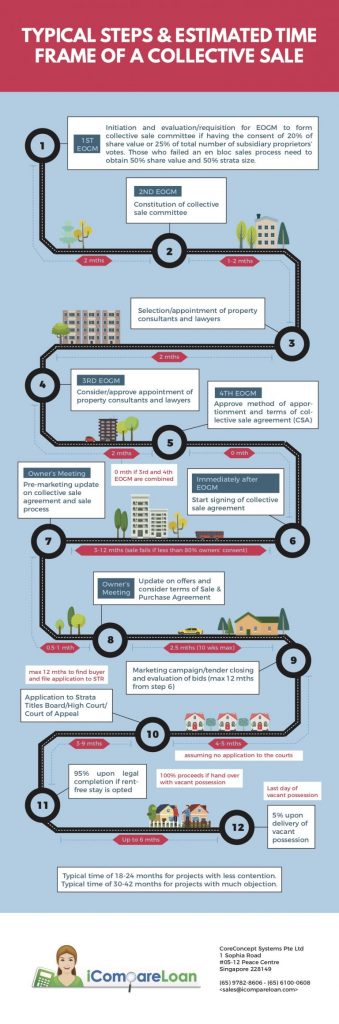

Collective sale process takes 20 to 30 months to complete and during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties in the Mount Elizabeth-Orchard area but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.