While 2013 will probably go down in the history of the Singapore’s real estate market as the year with the most number of property rules and home mortgage regulations being rolled out, not all the crop of measures apply to refinancing facilities.

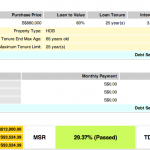

To jog your memories, dear readers, we present in Table 1, the home mortgage rules introduced since 2012, that apply to refinancing.

Table 1: Rules for Refinancing

| With Effect From | Rules |

| 6 Oct 2012 | The maximum tenure of all residential property loans for individual and non-individual borrowers will be capped at 35 years.The sum of the tenure of the re-financing facility and the number of years since the first housing loan granted to the borrower for the purchase of that residence was first disbursed, cannot exceed 35 years. |

| 12 Jan 2013 | HDB loans by FIs: A Mortgage Servicing Ratio (MSR), or percentage of total monthly mortgage obligations to gross monthly income, not exceeding 30% will apply. |

| 29 Jun 2013 | A Total Debt Servicing Ratio (TDSR), or percentage of total monthly debt obligations to gross monthly income, not exceeding 60%, will apply to all property loans granted by FIs to individuals.A mandatory interest rate of 3.5% (4.5%) p.a. or the prevailing market interest rate, whichever is higher, has to be used in the computation of MSR and TDSR for residential (non-residential) loans. |

| 28 Aug 2013 | HDB loans by FIs: The maximum loan tenure is reduced to 30 years.The sum of the tenure of the re-financing facility and the number of years since the first housing loan granted to the borrower for the purchase of that HDB flat was first disbursed, cannot exceed 30 years. |

| 10 Dec 2013 | Executive Condominium (EC) loans by FIs: A MSR cap of 30% for refinancing within the minimum occupation period of 5 years. |

Note that the HDB Concessionary Rate Loan is not available for refinancing. In other words, if a borrower has taken a loan by a FI to purchase a HDB flat he cannot refinance to the HDB Concessionary Rate Loan.

Ambiguity In Loan Tenure

A grey area in imposing a tenure cap on re-financing facilities is whether the number of years already spent servicing the previous loan will be taken into account when deciding on the maximum tenure of the new loan, if the sum of the loan duration for the new loan and the years already spent does not exceed the cap.

For instance after the imposition of the 35-year loan cap in 6 October 2012, a handful of banks deduct the number of years used in financing the previous loan from the maximum duration allowed for the new loan.

Example:

1st Loan: Taken in 2008

In December 2012, the borrower decides to refinance.

Number of Years Already Used In Financing 1st Loan = 4

As the sum of the tenure of the re-financing facility and the number of years since the first housing loan granted to the borrower for the purchase of that residence was first disbursed, cannot exceed 35 years:

Technically Maximum Years Allowed For Refinancing = 35-4 = 31

However a handful of oddball banks take into consideration the 4 years already spent, so if the borrower is qualified for a maximum tenure of 20 years based on the bank’s assessment of his financial profile, the duration for the refinanced loan will be slashed into 16 years.

In reality the sum of the 4 years already spent and the 20-year duration of the refinanced loan only adds up to 24 years, which is below the 35 years cap, and in compliance with MAS rule of the sum not exceeding 35 years.

Thankfully, such cases are on the decline. If you are in need of more explanation about the ABCs of the string of mortgage rules to decide on a suitable Singapore home loan, turn to the free service of an iCompareLoan mortgage expert today!

For advice on a new home loan.

For refinancing advice.

Download this article here.